Exploring AARP Health Insurance: A Comprehensive Guide

Delve into the realm of AARP health insurance as we uncover the intricacies of this vital coverage option. From its unique features to the array of plans offered, this guide aims to provide a holistic understanding for all.

With a focus on clarity and depth, we aim to equip readers with valuable insights into the world of AARP health insurance.

Overview of AARP Health Insurance

AARP Health Insurance offers a range of health coverage options tailored to the needs of older adults, aged 50 and above. The insurance plans are designed to provide comprehensive coverage and peace of mind for individuals in this demographic.

Target Demographic

The target demographic for AARP Health Insurance primarily includes individuals aged 50 and above who are looking for reliable health coverage options. These plans are specifically designed to cater to the unique healthcare needs of older adults, offering benefits that are tailored to their age group.

Unique Features or Benefits

- Customized Coverage: AARP Health Insurance plans are customized to address the specific healthcare needs of older adults, including coverage for prescription medications, preventive care, and chronic condition management.

- Provider Network: AARP Health Insurance offers access to a wide network of healthcare providers, ensuring that members have options for quality care and services.

- Wellness Programs: The insurance plans may include wellness programs and resources to help members maintain and improve their health, such as fitness classes, nutrition counseling, and health screenings.

- Financial Protection: AARP Health Insurance provides financial protection against high medical costs, offering peace of mind and security for individuals in their retirement years.

Types of Health Insurance Plans Offered by AARP

AARP offers a variety of health insurance plans tailored to meet the diverse needs of its members. Each plan comes with specific coverage options and eligibility requirements, ensuring that individuals can find a plan that suits their unique healthcare needs.

Medicare Advantage Plans

- Provides coverage beyond Original Medicare, including vision, hearing, dental, and prescription drugs.

- May have lower out-of-pocket costs than Original Medicare.

- Enrollment is typically for those aged 65 and older, or those who qualify due to disability.

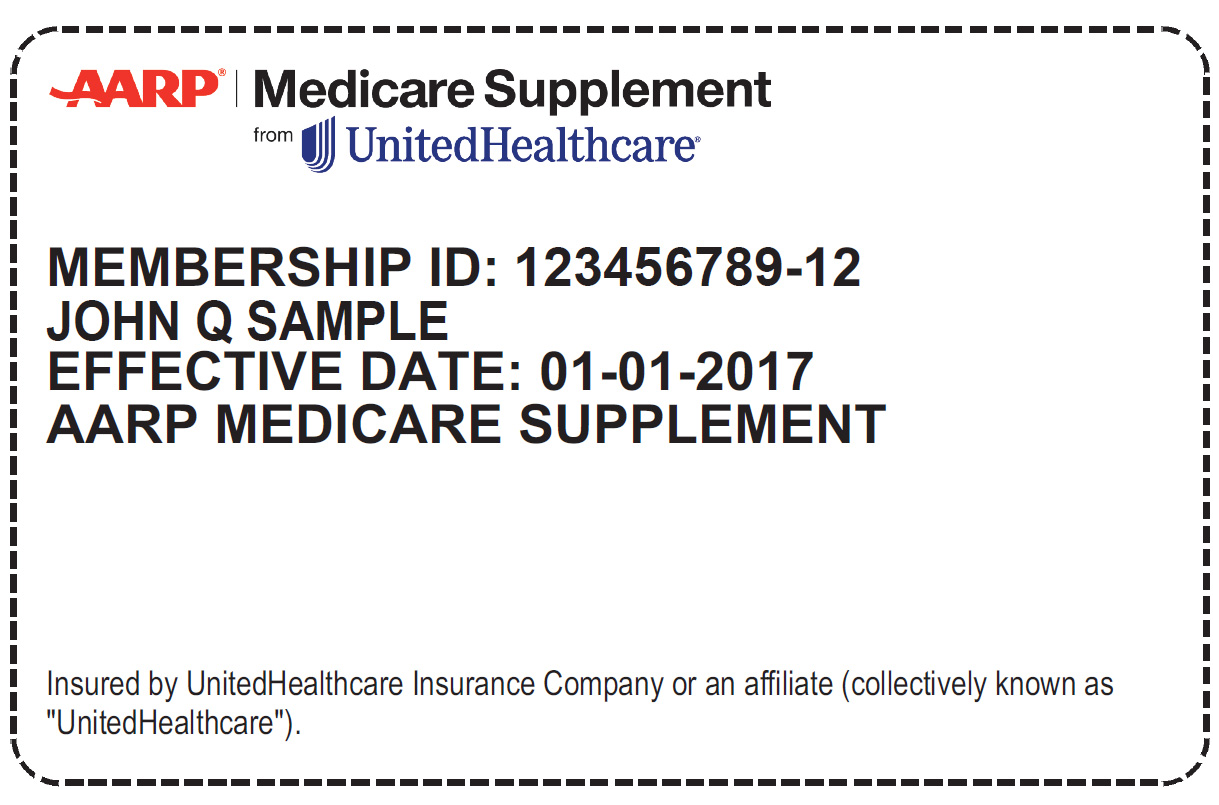

Medicare Supplement Insurance Plans

- Helps pay for out-of-pocket costs not covered by Original Medicare, such as copayments and deductibles.

- Gives you the freedom to choose any doctor or hospital that accepts Medicare patients.

- Available to individuals already enrolled in Medicare Parts A and B.

Prescription Drug Plans (Part D)

- Covers prescription medications not included in Original Medicare.

- Allows you to choose from a list of covered drugs at pharmacies in your network.

- Available to individuals enrolled in Medicare Part A or Part B.

Medicare Advantage Special Needs Plans

- Designed for individuals with specific health conditions or living in certain institutions.

- Offers tailored benefits and services to meet the unique needs of each individual.

- Eligibility requirements are based on specific health conditions or institutional residence.

Cost and Affordability

When it comes to AARP Health Insurance plans, affordability is a key factor that the organization prioritizes to ensure that members can access quality healthcare without breaking the bank.

Cost Structure of AARP Health Insurance Plans

- AARP offers a range of health insurance plans, including Medicare Advantage, Medicare Supplement, and prescription drug coverage.

- The cost of these plans can vary based on factors such as age, location, and the specific coverage options chosen.

- Members typically pay a monthly premium, along with potential out-of-pocket costs like deductibles, copayments, and coinsurance.

Discounts and Savings Available for Members

- AARP often negotiates discounts with healthcare providers and pharmacies on behalf of its members, helping them save money on medical services and prescription medications.

- Members may also be eligible for savings on wellness programs, vision and dental care, and other health-related expenses.

- Additionally, AARP Health Insurance may offer incentives for members who engage in healthy behaviors or participate in preventive care services.

Ensuring Affordability for Members

- AARP works diligently to keep premiums and overall costs competitive for its members, striving to provide value and quality in healthcare coverage.

- Through partnerships with insurance providers and advocacy efforts, AARP aims to make healthcare more accessible and affordable for older adults.

- Members can also take advantage of resources and tools provided by AARP to help them understand their coverage options and make informed decisions about their healthcare needs.

Provider Network and Coverage

When it comes to AARP Health Insurance, the provider network and coverage options play a crucial role in ensuring members have access to quality healthcare services. Let's dive into the details of the network of healthcare providers associated with AARP Health Insurance and the coverage options available for in-network and out-of-network services.

Network of Healthcare Providers

AARP Health Insurance works with a wide network of healthcare providers across the country to ensure members have access to a variety of medical services. The network includes hospitals, physicians, specialists, clinics, and other healthcare facilities that meet AARP's standards for quality care.

- In-network Services: Members can benefit from lower out-of-pocket costs when they choose healthcare providers within the AARP network. This includes primary care visits, specialist consultations, preventive care services, diagnostic tests, and more.

- Out-of-network Services: While AARP Health Insurance primarily encourages members to seek care within the network, coverage is still available for out-of-network services. However, members may have higher out-of-pocket costs for services received outside the network.

Coverage Options

AARP Health Insurance offers comprehensive coverage for a wide range of medical services to ensure members can access the care they need without financial burden. Here are some examples of specific medical services covered by the insurance:

- Doctor Visits: Coverage for primary care physician visits, specialist consultations, and follow-up appointments.

- Hospital Services: Coverage for inpatient and outpatient hospital services, including surgeries, treatments, and therapies.

- Prescription Drugs: Coverage for prescription medications, with options for mail-order delivery and retail pharmacy pick-up.

- Preventive Care: Coverage for preventive services such as screenings, vaccinations, and wellness programs to promote overall health and well-being.

- Mental Health Services: Coverage for mental health counseling, therapy sessions, and treatment for behavioral health conditions.

Member Benefits and Additional Services

As a member of AARP Health Insurance, you can enjoy a range of additional benefits and services beyond basic health coverage.

Wellness Programs and Preventive Care Services

AARP Health Insurance offers various wellness programs and preventive care services to help members maintain their health and well-being. These programs may include access to screenings, vaccinations, health coaching, and resources for managing chronic conditions.

Discounts and Perks

Members of AARP Health Insurance may also receive discounts and perks that can help them save money on healthcare-related expenses. These discounts could apply to prescription medications, vision and dental services, gym memberships, and other health-related products and services. Additionally, members may have access to exclusive offers and rewards programs designed to enhance their overall healthcare experience.

Customer Experience and Satisfaction

Customer satisfaction is a crucial aspect of any health insurance provider, including AARP Health Insurance. Let's delve into the overall customer experience and satisfaction levels with AARP Health Insurance.

Member Feedback and Reviews

- Many current and past members of AARP Health Insurance have expressed satisfaction with the coverage options and benefits provided.

- Members appreciate the ease of accessing healthcare services through AARP's network of healthcare providers.

- Feedback often highlights the helpfulness of customer service representatives in addressing queries and concerns promptly.

Addressing Customer Concerns

- AARP Health Insurance values customer feedback and actively works to address any concerns raised by members.

- The provider strives to improve customer experience by enhancing communication channels and streamlining processes.

- In cases of billing issues or claim disputes, AARP Health Insurance has a dedicated team to assist members in resolving such matters efficiently.

Enrollment Process and Support

When it comes to enrolling for AARP Health Insurance, the process is designed to be straightforward and user-friendly. Here is a breakdown of the steps involved and the support available to members throughout the enrollment process.

Enrollment Process Steps:

- Visit the AARP Health Insurance website or call the customer service hotline to start the enrollment process.

- Provide necessary personal information, such as your name, address, date of birth, and contact details.

- Select the type of health insurance plan that best suits your needs and preferences.

- Review the plan details, coverage options, and costs associated with the chosen plan.

- Complete the enrollment form and submit any required documentation for verification.

- Confirm your enrollment and make the initial payment to activate your health insurance coverage.

Support Available:

- AARP customer service representatives are available to assist members with any questions or concerns they may have during the enrollment process.

- Online resources, such as FAQs and video tutorials, are provided to guide members through the enrollment steps and address common issues.

- Enrollment support events and seminars may be organized to help members understand their options and make informed decisions.

Tips for Navigating the Enrollment Process:

- Start the enrollment process early to allow ample time for research and decision-making.

- Gather all necessary documents and information beforehand to expedite the enrollment process.

- Reach out to customer support if you encounter any difficulties or have questions about specific plan details.

- Compare different health insurance plans offered by AARP to find the one that best fits your healthcare needs and budget.

- Take advantage of enrollment support resources to ensure a smooth and successful enrollment experience.

End of Discussion

In conclusion, AARP health insurance stands as a beacon of support for its members, offering a blend of benefits and coverage that cater to diverse needs. As you navigate the realm of health insurance, let AARP be your guiding light towards a secure and healthy future.