Understanding Christian Health Insurance: A Comprehensive Guide

Christian health insurance is a unique and often misunderstood concept that offers an alternative to traditional health insurance plans. At its core, Christian health insurance is based on the principles of shared responsibility and faith-based community support.

As we delve deeper into the topic, we will explore the ins and outs of Christian health insurance, from its types and providers to its cost and eligibility criteria. By the end of this guide, you will have a solid understanding of this alternative healthcare financing option and its potential benefits for you and your family.

Overview of Christian Health Insurance

Christian health insurance is a type of healthcare coverage that operates on the principles and beliefs of the Christian faith. It is an alternative to traditional health insurance and provides an affordable way for individuals and families to manage their healthcare expenses.

The Concept of Christian Health Insurance

Christian health insurance, also known as health sharing ministries, is based on the idea of sharing healthcare costs among members of a community who hold similar religious beliefs. Members of a health sharing ministry contribute a set amount of money each month, which is then used to pay for the medical expenses of other members.

In contrast to traditional health insurance, health sharing ministries are not insurance companies and are not subject to the same regulations.

Principles and Beliefs Behind Christian Health Insurance

Health sharing ministries operate based on the principles of caring for one another and sharing each other's burdens, as Artikeld in the Bible. Members of these ministries believe that it is their responsibility to help others in need, and that by sharing their resources, they can provide for the medical needs of their community.

In addition, health sharing ministries often have guidelines for healthy living and require members to abstain from certain behaviors, such as smoking or excessive drinking.

Comparison with Traditional Health Insurance

Christian health insurance differs from traditional health insurance in several ways. First, health sharing ministries are not insurance companies and are not regulated by the government. This means that they have more flexibility in terms of what they cover and how they operate.

Second, health sharing ministries often have lower monthly contributions than traditional health insurance, making them a more affordable option for many people. However, it is important to note that health sharing ministries do not guarantee coverage and may not cover certain medical expenses, such as pre-existing conditions.

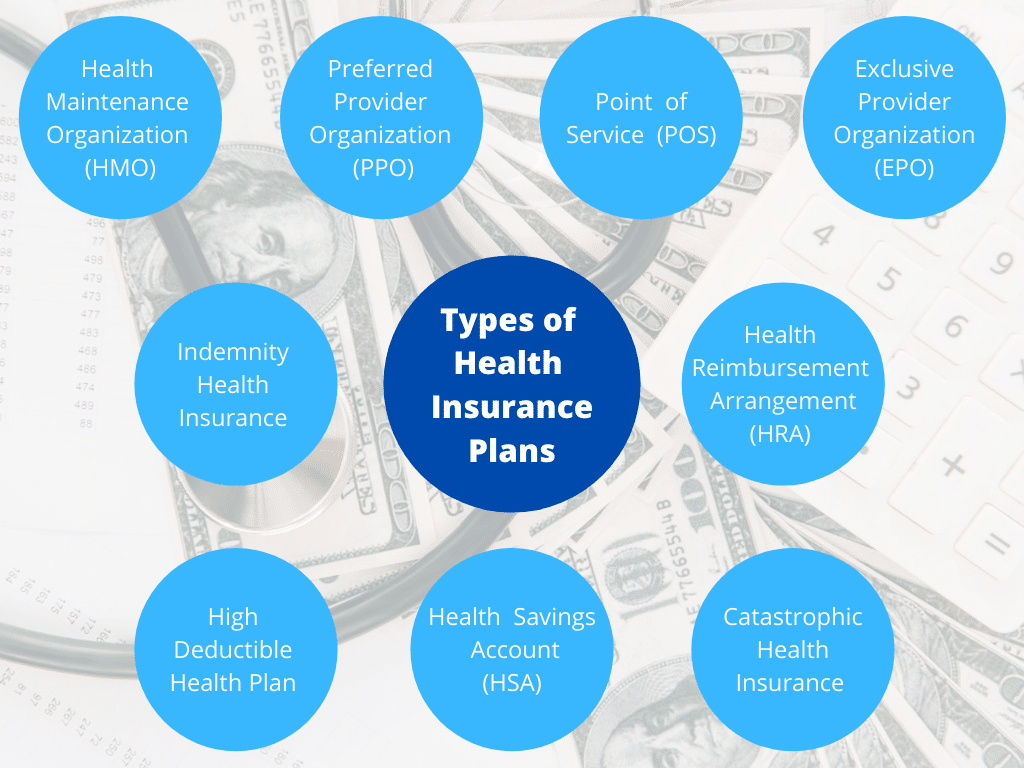

Types of Christian Health Insurance

Christian health insurance, or health care sharing ministries (HCSMs), come in various forms designed to meet the diverse needs of Christians. Each type has its own coverage and benefits, making it crucial for potential members to understand the differences between the plans before making a decision.

Health Care Sharing Ministries (HCSMs)

Health Care Sharing Ministries (HCSMs) are organizations that facilitate the sharing of healthcare costs among their members, based on the principles of Christianity. These programs are recognized by the Affordable Care Act (ACA) as an alternative to traditional health insurance.

Each HCSM has its unique features, but the main idea is to share medical expenses among members. The primary types of HCSMs are:

- Samaritan Ministries International (SMI): SMI is one of the oldest HCSMs, established in 1993. Members share each other's medical needs, and the organization manages the process. SMI asks its members to pray for and send checks directly to those in need.

- Christian Healthcare Ministries (CHM): CHM is a non-profit organization, founded in 1981, that allows members to share medical expenses. CHM offers three different programs: Gold, Silver, and Bronze, with varying levels of coverage and cost-sharing for members.

- Medical Cost Sharing (MCS): MCS is a more recent HCSM, offering a variety of programs catering to different needs. Members have the choice of several plan levels with varying deductibles and cost-sharing percentages.

Differences between HCSMs

Among the primary types of Christian health insurance, the main differences lie in the specifics of how the organizations facilitate healthcare cost sharing. These differences include:

- Annual Unshared Amount (AUA): The AUA is the amount a member must pay before the HCSM starts sharing their medical expenses. Each HCSM has a different AUA, affecting the cost of the program.

- Annual Limits: While some healthcare sharing ministries have no annual limits, others may enforce them, meaning that once the limit is reached, the organization will no longer share the member's medical expenses within that year.

- Eligibility: Every HCSM has its unique set of requirements for membership, such as lifestyle and faith-related expectations.

It's essential for those seeking Christian health insurance to compare the types and thoroughly review each HCSM's specific coverage and benefits. While some HCSMs offer more flexibility, others may have lower costs and more restrictions. By understanding the differences, potential members can make an informed decision about the best plan for their individual healthcare needs.

Providers of Christian Health Insurance

Christian health insurance is a unique alternative to traditional health insurance, providing faith-based options for individuals and families seeking healthcare coverage. There are several major providers of Christian health insurance, each with their own services and offerings.When it comes to selecting a Christian health insurance provider, consider the reputation, affordability, and the range of services provided.

It is crucial to compare the offerings of different providers to ensure you are choosing the best option for your healthcare needs.

Medi-Share

Medi-Share is one of the largest and most popular Christian health insurance providers in the United States. Established in 1993, Medi-Share is a faith-based health care sharing ministry that serves over 400,000 members nationwide. Members of Medi-Share share the cost of medical expenses through a monthly contribution.

There are no pre-existing condition exclusions, and members can choose their own healthcare providers.

Samaritan Ministries

Samaritan Ministries is a Christ-centered non-profit organization that facilitates the sharing of medical burdens among their members. Founded in 1991, Samaritan Ministries serves over 270,000 individuals and families across the U.S. Members agree to pray for and send financial assistance directly to other members who have medical needs, bypassing the need for health insurance.

Christian Healthcare Ministries

Christian Healthcare Ministries (CHM) is a non-profit, voluntary cost-sharing organization founded in 1981. CHM is endorsed by hundreds of churches and serves over 160,000 members in all 50 states and around the world. CHM's members share eligible medical bills, and they offer three levels of participation to suit different financial situations.

How to Select a Christian Health Insurance Provider?

When choosing a Christian health insurance provider, follow these steps to ensure the best fit for your healthcare needs:

1. Research the provider's reputation

Look for testimonials, reviews, and ratings from existing members and industry experts.

2. Understand the costs

Obtain a detailed quote from each provider you are considering. Include any additional fees or costs associated with membership.

3. Verify services offered

Consider the range of services provided, such as telemedicine, annual physicals, and access to specialty care.

4. Examine the provider network

Determine if your preferred healthcare providers and facilities are within the provider's network.

5. Take note of the enrollment process

Understand the enrollment requirements and timeframes for each provider.

Eligibility for Christian Health Insurance

Becoming a member of a Christian health insurance program generally requires applicants to meet certain criteria. While each provider might have unique requirements, most share some common eligibility factors and enrollment processes.

Common Eligibility Criteria

The majority of Christian health insurance providers look for:

- Active membership in a recognized Christian church 1.

- Profession of Christian faith. 2

- Agreement with the statement of faith or mission of the health care sharing ministry. 3

Many health care sharing ministries maintain a list of participating churches or denominations, while others have a more open approach with additional requirements, such as engaging with a church community or completing a spiritual growth class.4

Required Documents

To establish eligibility, insurers often ask for:

- A signed declaration of faith or membership form.

- Proof of membership in a qualifying church or denomination.

- Proofs of age, identity, and address.

Enrollment Process

The enrollment process typically involves:

- Submitting the required documents.

- Paying a membership or sign-up fee (if necessary).

- Understanding and accepting the program's guidelines and responsibilities. 5

Be sure to review each provider's enrollment instructions and expectations thoroughly. Some Christian health insurance organizations may require applicants to have a personal relationship with Jesus Christ or complete a health questionnaire.6

Cost of Christian Health Insurance

Christian health insurance aims to support an individual's healthcare expenses while adhering to Christian principles and beliefs. Its cost is an essential factor when considering such a plan.

Factors Affecting the Cost of Christian Health Insurance

Multiple factors determine the cost of Christian health insurance, including:

- Age: Older individuals usually pay higher premiums compared to younger members due to increased health risks.

- Location: Insurance costs vary depending on the state and region. More densely populated urban areas often have higher insurance costs than rural regions.

- Family Size: Larger families usually incur higher premiums since they require more coverage.

- Health Conditions: Pre-existing medical conditions and overall health impact the cost of insurance.

- Plan Coverage: Comprehensive plans with extensive benefits and lower deductibles typically cost more than high-deductible plans with limited coverage.

Payment Options for Christian Health Insurance

Christian health insurance providers offer different payment methods, including:

- Monthly, quarterly, or annual premium payments to maintain active coverage.

- Healthcare costs paid directly or through reimbursement programs.

- HSA (Health Savings Account) or FSA (Flexible Savings Account) contributions to cover out-of-pocket medical expenses.

Comparing Christian Health Insurance with Traditional Health Insurance Costs

Christian health insurance often has lower costs than traditional health insurance for several reasons:

- Lower administrative costs due to non-profit status and shared risk among members.

- Flexible plan options tailored to specific needs, potentially reducing unnecessary expenses and coverage.

- Lower rates for younger, healthier individuals, who can find affordable insurance without being burdened by older, less healthy participants.

While Christian health insurance can be a cost-effective alternative to traditional insurance, it's crucial to consider specific factors, payment options, and the overall context of these plans to make informed coverage decisions.

Coverage and Benefits of Christian Health Insurance

Christian health insurance plans aim to provide affordable healthcare services for individuals and families who share the same religious beliefs. These plans focus on the spiritual and physical well-being of their members while striving to maintain a balance between cost and coverage.

Shared Beliefs and Responsibilities

Members of Christian health insurance programs often share similar religious beliefs, which allows them to feel connected and supportive of one another. This community spirit creates a shared responsibility for their members' health, leading to a network of trust and support.

As a result, these insurance plans offer various coverage and benefits for their members.

Wide Range of Coverage and Benefits

Some Christian health insurance plans may feature a wide range of coverage and benefits, including preventive care, doctor visits, hospitalizations, surgeries, and prescription medications. Some plans may also offer additional benefits such as mental health services, dental and vision care, and alternative therapies like chiropractic and acupuncture.

Coverage Limitations and Exclusions

While Christian health insurance may offer extensive coverage and benefits, there can be limitations and exclusions to consider. For instance, pre-existing conditions, certain procedures, and experimental treatments may not be covered, or there might be annual or lifetime limits on coverage.

Additionally, some plans may have specific requirements, such as attending church or participating in religious activities, to be eligible for coverage.

Comparing Christian Health Insurance and Traditional Plans

Christian health insurance plans differ from traditional health insurance in their focus on shared religious beliefs, community support, and often have a more limited provider network. On the other hand, traditional health insurance usually covers a wider range of services and providers, but it tends to be more expensive.

By comparing the coverage, benefits, and costs of both types of plans, individuals and families can make informed decisions on what best meets their health and financial needs.

Comparison of Christian Health Insurance with Traditional Health Insurance

Christian health insurance and traditional health insurance serve the same basic purpose of providing healthcare coverage, but they differ in many significant ways.

Differences in Structure and Philosophy

Traditional health insurance is a for-profit business, whereas Christian health insurance operates as a non-profit entity based on the principles of sharing and community support. Traditional health insurance plans are regulated by state and federal laws, while Christian health insurance plans, also known as health sharing ministries, are exempt from many of these regulations.

Advantages of Christian Health Insurance

One major advantage of Christian health insurance is typically lower monthly premiums compared to traditional health insurance. Additionally, health sharing ministries often have less bureaucracy, making it easier for members to receive care quickly and access necessary treatments. Some members also appreciate the sense of community and shared values that come with being part of a health sharing ministry.

Disadvantages of Christian Health Insurance

Christian health insurance plans are not obligated to pay for medical services, leaving members vulnerable when needs arise that aren't shared among the community. They also don't provide the same level of guaranteed coverage as traditional insurance. Some Christian health insurance plans may have limitations on pre-existing conditions and may not cover certain types of care, such as mental health services or rehabilitation.

Comparison of Cost, Coverage, and Eligibility

On average, Christian health insurance plans have lower monthly premiums than traditional health insurance plans. However, this can vary greatly depending on the specific plan and the level of coverage. Membership in a health sharing ministry typically involves a statement of faith, while traditional health insurance does not have religious requirements. Traditional health insurance is required by law to cover essential benefits, while Christian health insurance may or may not cover certain treatments.

Combining Traditional and Christian Health Insurance

In some cases, individuals may choose to carry both traditional health insurance and a Christian health insurance plan. This can offer a comprehensive level of coverage and protection against unforeseen medical costs. It can also allow members to take advantage of the lower monthly premiums offered by Christian health insurance while retaining the guaranteed coverage provided by traditional health insurance.

Common Myths and Misconceptions about Christian Health Insurance

While Christian health insurance has been growing in popularity, there are still many misconceptions surrounding it. This section addresses some of these myths and sheds light on the reality behind them.

Myth: Christian health insurance is only for Christians

The reality is that although Christian health insurance was founded on Christian principles, it is open to people of all faiths. It is not a requirement to be a Christian to enroll.

Myth: Christian health insurance does not provide comprehensive coverage

In fact, many Christian health insurance providers offer a wide range of coverage options, often at lower costs than traditional health insurance. Members can choose from various coverage plans, including hospital visits, doctor's appointments, prescription drugs, and preventive care.

Myth: Christian health insurance is not regulated

Christian health insurance must follow the same regulatory guidelines as traditional health insurance. Providers must abide by state and federal laws, making them accountable and trustworthy.

Myth: Christian health insurance offers fewer benefits than traditional health insurance

Christian health insurance actually offers many benefits often overlooked by the general public. Some benefits include:

- Shorter waiting periods for pre-existing conditions

- Flexibility in choosing healthcare providers

- Freedom to customize plans based on personal needs

- Potential for lower costs compared to traditional health insurance

- Strong focus on preventive care

Outcome Summary

Christian health insurance is a viable alternative to traditional health insurance, offering a unique approach to healthcare financing. While it may not be the right choice for everyone, it is worth considering, especially for those who share the same faith and values.

As with any important decision, it is essential to weigh the pros and cons and do your research before making a choice.