Exploring the Intricacies of Health Insurance Plans for Families

Health insurance plans for families are a crucial aspect of maintaining the wellbeing of your loved ones. These plans provide access to essential medical services, shielding families from the financial burden of unexpected healthcare costs. With a myriad of options available, it's vital to understand the key components, benefits, and drawbacks of each type of family health insurance plan.

In this exploration, we delve into the world of health insurance plans for families, providing an informative overview of the coverage, financing, enrollment, and management of these vital plans. So, let's embark on this fascinating journey together!

Understanding Health Insurance Plans for Family

Health insurance plans for families are designed to provide financial protection and access to quality healthcare services for all members of a household. These plans typically offer comprehensive coverage for various medical services, including preventive care, doctor visits, hospitalizations, surgeries, and prescription medications.Having health insurance for families is essential for several reasons.

First, it ensures that family members have access to necessary medical care without facing overwhelming financial burdens. Second, it encourages preventive care and early detection of health issues, which can lead to improved health outcomes and lower overall healthcare costs.

Lastly, it provides peace of mind, knowing that loved ones are covered in case of unexpected medical emergencies.

Key Components of Family Health Insurance Plans

Family health insurance plans generally consist of the following components:

1. Network of Providers

Insurance companies typically have contracts with healthcare providers, such as doctors, hospitals, and clinics, to form a network. Plans often cover a higher percentage of costs when using in-network providers.

2. Types of Coverage

Plans usually offer various levels of coverage, such as HMOs, PPOs, EPOs, and POS plans. Each type has its own rules regarding provider networks, cost-sharing, and flexibility in choosing healthcare services.

3. Cost-Sharing

This includes deductibles, copayments, and coinsurance. Deductibles are the amount a family must pay out-of-pocket before insurance starts covering costs. Copayments are fixed amounts paid for specific services, while coinsurance represents a percentage of the total cost after meeting the deductible.

4. Out-of-Pocket Maximums

This is the maximum amount a family will pay for healthcare services in a plan year. Once this limit is reached, the insurance company covers 100% of additional costs.

5. Preventive Care Services

Many plans cover preventive care services, such as vaccinations, screenings, and wellness exams, at little or no cost to the policyholder.

6. Prescription Drug Coverage

Plans typically provide coverage for prescription medications, with varying levels of cost-sharing and coverage tiers.

How to Choose a Family Health Insurance Plan

When selecting a family health insurance plan, consider the following factors:

Premium Costs

Monthly or annual premiums affect how much a family pays for coverage. Balancing premium costs with coverage levels and out-of-pocket expenses is crucial.

Network of Providers

Ensure that preferred doctors and hospitals are in the plan's network.

Types of Coverage

Consider the flexibility and restrictions of different plan types, such as HMOs and PPOs.

Cost-Sharing

Compare deductibles, copayments, and coinsurance to determine the potential out-of-pocket costs for the family.

Coverage for Preventive Care and Prescription Drugs

Ensure that essential preventive care services and medications are covered.Ultimately, the best family health insurance plan will balance cost, coverage, and access to quality healthcare providers. By taking the time to understand these components, families can make informed decisions and secure the right coverage for their needs.

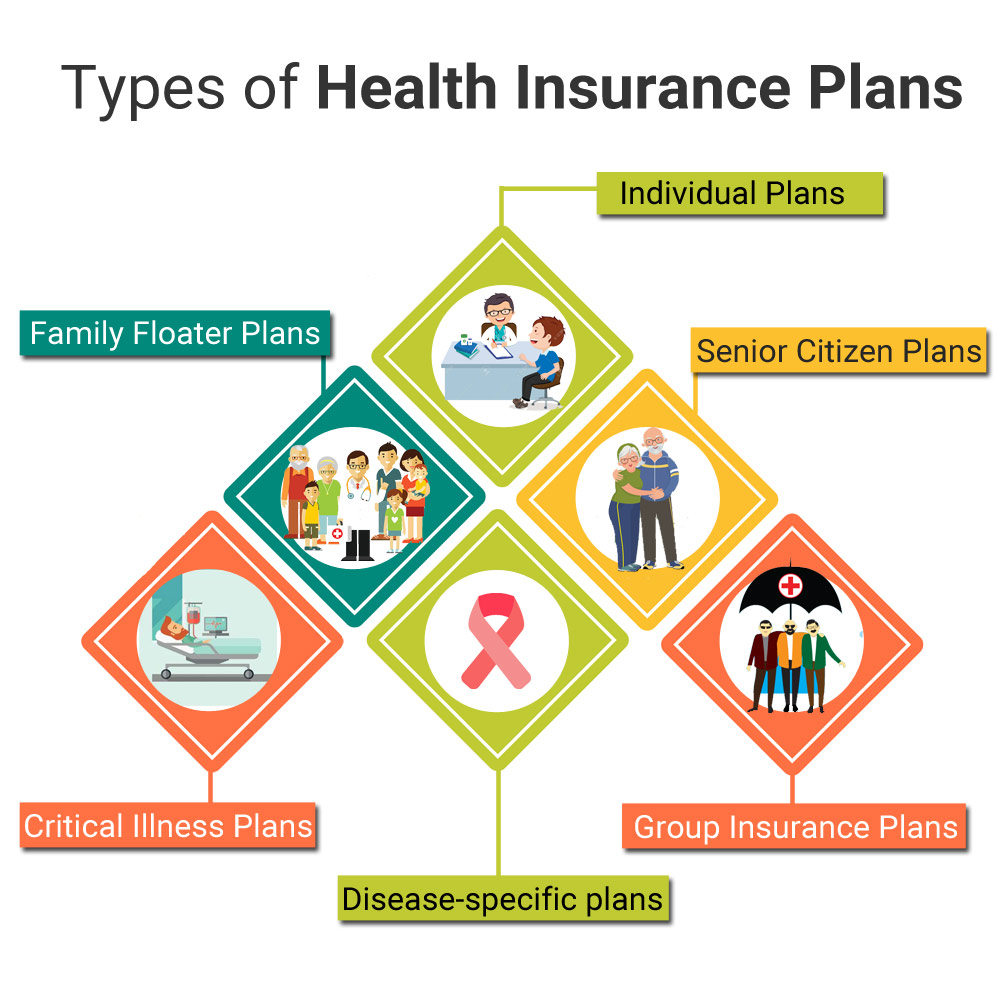

Types of Health Insurance Plans for Families

When selecting a health insurance plan for your family, it's essential to understand the various types available and their respective benefits and drawbacks. Here, we'll compare HMO, PPO, POS, EPO, and HSA plans, providing examples of when they might be the best choice.

Health Maintenance Organization (HMO)

With HMOs, your choice of healthcare providers is limited to a network. You'll need a referral from your primary care physician (PCP) to see a specialist. While HMOs often have lower premiums, they may not provide coverage outside the network and could have higher out-of-pocket costs for certain services.

- Suitable for: Families that prioritize lower premiums, are comfortable with selecting providers from a designated network, and do not require frequent specialist care.

Preferred Provider Organization (PPO)

PPOs offer more flexibility in terms of healthcare providers, as you can visit both in-network and out-of-network providers, although out-of-network care might cost more. PPOs do not require referrals for specialist visits but typically have higher premiums.

- Suitable for: Families seeking flexibility with their choice of doctors, especially those requiring frequent specialist care, and who can afford higher premiums.

Point of Service (POS)

POS plans combine elements of both HMOs and PPOs. You can choose in-network or out-of-network healthcare providers but may need a referral for specialist care. The premiums for POS plans are typically in the middle range, and you can expect moderate out-of-pocket costs.

- Suitable for: Families that want a balance between cost and flexibility, with the ability to see specialists without a referral.

Exclusive Provider Organization (EPO)

EPOs provide a fixed network of healthcare providers and specialists, similar to HMOs, but do not require referrals for specialist visits. EPO plans offer lower premiums compared to PPOs but will not cover out-of-network care, except in emergencies.

- Suitable for: Cost-conscious families comfortable using only in-network providers and needing occasional specialist care.

Health Savings Account (HSA) Plans

An HSA plan is a high-deductible health plan (HDHP) that pairs with a tax-advantaged savings account. You can use money in the savings account for qualified medical expenses, providing a tax benefit. HSA plans often have lower premiums but a higher deductible, making them suitable for families willing to assume higher out-of-pocket costs.

- Suitable for: Healthy families prepared to take on more risk with a high deductible, seeking a tax benefit on qualified medical expenses.

When selecting the right health insurance plan for your family, consider the flexibility, coverage, and costs that best fit your specific circumstances.

Coverage and Benefits of Family Health Insurance Plans

Selecting a health insurance plan for your family involves considering the coverage and benefits that best suit your family's needs. Comprehensive family health insurance plans typically include preventive care, hospitalization, mental health services, and more. However, it is essential to be aware of any limitations or exclusions in coverage.Family health insurance plans generally offer a wide range of benefits, such as:

- Preventive care, including vaccinations, screenings, and check-ups, to maintain your family's health and identify potential issues early on.

- Hospitalization coverage for surgeries, emergency care, and inpatient treatments, often including room and board, doctor's fees, and diagnostic services.

- Mental health services, such as counseling, therapy, and psychiatric care, to support your family's emotional well-being.

- Prescription drug coverage, which may include generic, brand-name, and specialty medications, as well as mail-order services.

- Rehabilitation services, such as physical therapy and occupational therapy, following an injury, surgery, or illness.

- Dental and vision coverage, offering services like cleanings, fillings, exams, and eyewear.

Understanding Limitations and Exclusions

Despite the extensive benefits offered by family health insurance plans, it is crucial to be aware of the limitations and exclusions. Some common limitations include:

- Annual and lifetime coverage limits, which cap the total amount the insurer will pay for specific services or treatments.

- Pre-existing condition exclusions, which may deny or limit coverage for conditions diagnosed prior to enrollment.

- Network restrictions, which may require you to use specific healthcare providers or facilities to receive full coverage.

- Waiting periods, which require you to wait a certain amount of time after enrollment before coverage for specific services or treatments begins.

Maximizing Family Health Insurance Plan Benefits

To make the most of your family health insurance plan, consider the following tips:

- Stay within your plan's network of healthcare providers and facilities to avoid unexpected out-of-pocket costs.

- Take advantage of preventive care services, such as screenings and vaccinations, to maintain your family's health and potentially avoid more costly treatments in the future.

- Understand your plan's coverage for mental health services, as many plans offer extensive coverage for these essential services.

- Review your plan's prescription drug coverage, and consider using mail-order services for long-term medications to save on costs.

- Consider enrolling in a flexible spending account (FSA) or health savings account (HSA) to set aside pre-tax dollars for out-of-pocket healthcare expenses.

Cost and Financing of Family Health Insurance Plans

Obtaining health insurance for your family is essential, but it's also crucial to understand the factors influencing the cost and the available financing methods.

Factors Affecting the Cost of Family Health Insurance Plans

-

The cost of family health insurance plans hinges on various factors including the number of family members, their age distribution, individual health conditions, deductibles, co-pays, and out-of-pocket maximums.

-

Insurers also consider the region and cost of healthcare services. Insurance costs are generally higher in urban areas or locations where healthcare services are expensive.

-

The chosen plan type, such as HMOs, PPOs, EPOs, and POS plans, also affect costs as premiums vary based on the level of network restrictions and flexibility that each plan offers.

Financing Methods for Family Health Insurance Plans

Various financing options are available for family health insurance plans, each with its benefits and drawbacks:

Employer-Sponsored Health Insurance

Employer-sponsored health insurance plans enable many families to access affordable health insurance options through their workplace. Often, employers cover a larger portion of the premium costs, reducing the financial burden on families.

Individual Marketplace

The Affordable Care Act (ACA) created online marketplaces (exchanges) for individuals and families to purchase health insurance plans, offering a wide range of plan options and potential subsidies based on the household's income.

Medicaid

Medicaid offers health insurance coverage to eligible low-income individuals and families, providing financial assistance for medical services, including doctor visits, hospital stays, and medication.

Comparison of Costs and Benefits of Financing Methods

| Financing Method | Cost | Benefits |

|---|---|---|

| Employer-Sponsored | Shared costs with employer |

Wide range of plan options Cost containment |

| Individual Marketplace |

Premium costs based on plan and household income Potential subsidies |

Variety of plan options Access to ACA-compliant plans |

| Medicaid | No or low-cost based on eligibility |

Comprehensive coverage Low out-of-pocket for enrollees |

Enrollment and Eligibility for Family Health Insurance Plans

When it comes to enrolling in family health insurance plans, it's crucial to understand the eligibility requirements and enrollment periods. In this section, we will discuss these aspects in detail.

Eligibility for family health insurance plans typically depends on a few factors such as age, income, family size, and residency. Insurance companies may also have specific requirements related to pre-existing conditions or medical history. It is essential to thoroughly research the eligibility criteria before applying for a plan.

Eligibility Requirements

- Age:Most insurance providers require that applicants be at least 18 years old to apply for a health insurance plan, although some states may have different age requirements. Family members who are dependents, such as children, can typically be included on a family plan until they reach a certain age (usually 26).

- Income:Income can play a significant role in determining eligibility for certain family health insurance plans. For instance, income may affect eligibility for subsidies, tax credits, or Medicaid.

- Family Size:The number of family members and their relationship to the primary applicant can impact eligibility. Most insurance providers require that applicants have at least one dependent, such as a spouse or child, to apply for a family plan.

- Residency:Applicants must typically reside in the state where they are applying for health insurance. Some insurers may also have specific county or zip code requirements.

- Medical History and Pre-existing Conditions:While the Affordable Care Act (ACA) prohibits insurance providers from denying coverage based on pre-existing conditions, insurers can still impose waiting periods or charge higher premiums for certain conditions.

Enrollment Periods and Deadlines

- Open Enrollment Period:Open enrollment typically takes place once a year, usually from November 1st to January 15th. During this time, applicants can enroll in a new health insurance plan or change their existing plan.

- Special Enrollment Period:Certain life events, such as getting married, having a baby, or losing job-based health insurance, may qualify applicants for a special enrollment period. During this time, applicants can enroll in or change a health insurance plan outside of the open enrollment period.

- Medicaid and CHIP Enrollment:Medicaid and the Children's Health Insurance Program (CHIP) have continuous enrollment periods, meaning applicants can enroll at any time of the year.

Enrollment Process

- Research and compare various family health insurance plans to find the best fit for your family's needs and budget.

- Determine your eligibility for subsidies or tax credits that can help lower your premiums.

- Gather necessary documentation, such as identification, proof of income, and residency information.

- Apply for the health insurance plan through the marketplace, an insurance provider, or a broker.

- Wait for the insurance provider to review and approve your application. Once approved, you will receive a welcome packet with information about your coverage and premiums.

Managing and Utilizing Family Health Insurance Plans

Managing your family's health insurance plan effectively can help you make the most of your benefits, reduce costs, and ensure that your loved ones are well-protected. Here are some tips and strategies for maximizing the utility of your family's health insurance plan.

Regular Reviews and Updates

It's crucial to review and update your family health insurance plan periodically to ensure it continues to meet your family's needs and budget. This may involve reassessing your healthcare usage patterns, checking for new and better coverage options, and adjusting your premiums and deductibles accordingly.Consider the following:

- Review coverage, benefits, and costs annually during open enrollment

- Adjust deductibles and premiums based on your family's healthcare usage

- Factor in life changes, such as a new baby or aging parents, when updating your plan

Making the Most of Your Benefits

Use your health insurance benefits wisely to save money and improve your family's healthcare.

Stay in-network

Choose healthcare providers and facilities within your plan's network to avoid extra charges

Use preventive care

Many plans cover preventive services like vaccinations and annual check-ups at little or no cost

Understand your coinsurance, copayments, and deductibles

Knowing your financial responsibilities will help you plan for and budget healthcare expenses

Use your flexible spending account (FSA) or health savings account (HSA) if available

These accounts can help you save on taxes while covering eligible medical expenses

Resolving Disputes and Issues

Despite your best efforts, you might encounter a dispute or issue with your family health insurance plan. If this happens, take the following steps:

Document your concern

Keep a record of phone calls, emails, and any related bills or invoices

Contact your insurance company

Speak with a representative about the problem and be specific about your concerns

Follow up in writing

Send a detailed letter outlining the dispute and requesting a resolution

Seek assistance

If the problem remains unresolved, contact your state's department of insurance or consider mediation or arbitrationKeep in mind that managing your family health insurance plan effectively goes beyond simply choosing a plan and paying premiums. Regular reviews, smart utilization, and effective resolution of issues can help you make the most of your coverage and ensure your loved ones receive quality healthcare.

Ultimate Conclusion

As we conclude our journey through the realm of health insurance plans for families, it's clear that these plans play a fundamental role in protecting and maintaining the health of your loved ones. By understanding the different plan types, coverage, financing options, and enrollment processes, families can make informed decisions, ensuring they have the right plan for their specific needs.

Don't leave your family's health to chance - invest in a solid health insurance plan today!